I. Introduction

A. Recent Guidance Provides Relief

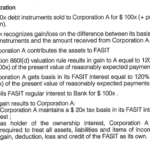

Chief among the federal government’s supports for the alternative energy industry is the section 45 production tax credit (PTC). Alone, the PTC is not sufficient to spur the production of wind energy, but partnerships between wind energy producers and financial institutions have transformed the tax credit into the major catalyst for growth in wind energy production.