Amended DI breaches the threshold yield solely because its market value, as measured by the issue price rules, was depressed on its issue date. This market value, however, reflected a dramatic drop in the demand for corporate debt instruments generally at that time. To avoid breaching this threshold, Amended DI’s issue price would have had to reflect a market value of more than 96 percent of its outstanding principal amount. This would have been implausible at the time the debt was amended; many bonds of solvent companies were trading at much lower values in the third and fourth quarters of 2008, including Macy’s 7 percent bonds which traded at 74 cents on the dollar, Home Depot 5.875 percent bonds at 54 cents, and Clear Channel Communications 7.25 percent bonds at 27 cents.60 Also, although plummeting demand for corporate debt had driven corporate yields higher, the threshold yield used for the AHYDO test fell because federal borrowing rates dropped over the same period.

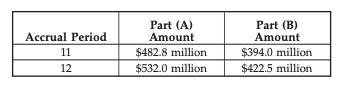

Amended DI’s low issue price not only causes it to breach the threshold yield, but also creates ‘‘significant OID.’’ Amended DI will have significant OID if the sum of all interest payments made and OID accrued from its issue date through the close of any accrual period ending more than five years later (the Part (A) Amount) exceeds the amount of interest paid over that same period plus Amended DI’s issue price multiplied by its yield to maturity (the Part (B) Amount). Because Amended DI has a term of six years and accrues interest semiannually, it has 12 accrual periods. Of those, periods 11 and 12 each end after the fifth anniversary of Amended DI’s issue date. The Part (A) Amount and Part (B) Amount for each

of these periods is:

The Part (A) Amount exceeds the Part (B) Amount in each of these accrual periods. Because this test is satisfied for at least one accrual period, Amended DI has significant OID. Thus, Amended DI fits the definition of an AHYDO, while Original DI does not. This is true even though Borrower decreased the amount of its borrowing by prepaying $100 million in principal, increased the amount of current interest payments from 6 percent to 7 percent of outstanding principal, and left the duration of

the borrowing unchanged. Examining Amended DI in the light of the policy enunciated in the legislative history to the AHYDO rules, Amended DI’s terms did not acquire any more equity flavor than those of Original DI.

As between Original DI and Amended DI in the facts we have described, there is no change in preference over, or lack of subordination to, other interests in the corporation, reduced insulation from risk of the corporation’s business, or reduced expectation of repayment. As for the yield test, the major determining factor in the significant OID test is Amended DI’s depressed issue price.

D. Implementation of AHDYO Rules

Discussion. The AHYDO rules state that, with respect

to an AHYDO issued by a corporation:

• no deduction shall be allowed . . . for the disqualified portion of the OID; and

• the remainder of such OID shall not be allowable as

a deduction until paid.61

This rule, therefore, disallows a portion (the ‘‘disqualified portion’’) of the total OID on an AHYDO, and defer any remaining deductible portion (the ‘‘remainder’’) until paid. In the absence of this rule, OID is deductible as

it accrues according to specific allocation rules, regardless of when cash payments are made. Therefore, the above rule affects both the amount of OID a borrower may deduct, as well as the timing of the deduction.

The disqualified portion of the OID is defined as the lesser of:

I. the amount of such OID; and

II. the portion of the ‘‘total return’’ on such obligation which bears the same ratio to such total return as the ‘‘disqualified yield’’ on such obligation bears to the yield to maturity (YTM) on such obligation. The calculation in subpart (II) (the Part (II) Calculation) can be expressed mathematically as:

Part (II) amount = total return x (disqualified yield /YTM

Total return is defined as the amount which would have been the OID on the obligation if QSI were included in the SRPM, and disqualified yield means the excess of the YTM on the obligation over the sum of the AFR + 6

percent. Therefore, these amounts can be expressed as:

Total return = OID + QSI

Disqualified yield = YTM – (AFR + 6 percent)

The disqualified portion is an amount calculated with respect to the total return on an AHYDO, subject to a maximum amount of disallowance equal to the total OID on the obligation. Because the amount of disallowance is

calculated by disallowing a portion of total return proportionate to the amount of yield that is deemed to be excessive (that is, the disqualified yield), it is possible for this calculation (the Part (II) Calculation) to result (the Part (II) Amount) in an amount that is greater than the total

OID on the obligation, even when the amount of yield that is disqualified is less than 100 percent of the total yield on the obligation. However, the ceiling on the amount of the disallowance provided by Part (I) ensures that the AHYDO rules will never disallow deductions for payments of QSI.