Regular interest

There are two categories of regular interests; in order to qualify under the first category, all of the following requirements must be met:

(1) the instrument must entitle the holder to a specific principal amount (or similar amount), which may be paid contingent on the timing (but not the amount) of prepayments on debt instruments and income from permitted assets held by the FASIT;

(2) interest payments, if any, are determined based on a fixed rate, or, excerpt to the extent provided otherwise by the Secretary, at variable rates permitted for REMIC interests;

(3) unless permitted by Treasury Regulations, the instruments may not have a stated maturity, including renewal options, greater than 30 years;

(4) it must have an issue price not exceeding 125 per cent of its stated principal amount;

(5) its yield to maturity must be less than 5 percentage points above the applicable federal rate based on the projected maturity for the regular interest.

If an instrument violates one or more of requirements (1), (4), or (5), it may qualify for the second category of regular interest, the high yield interest. The major consequence to characterization as a high yield regular interest is that such interests are subject to numerous restrictions upon transfer.

Ownership interest

The ownership interest is defined as the interest issued by a FASIT after the start-up day which is designated as an ownership interest and which is not a regular interest. A FASIT may have only one class of ownership interest that must be held directly by an eligible corporation. The holder of the ownership interest is required to treat all assets, liabilities, and items of income, gain, deduction, loss, and credit of the FASIT as its own. Regular interests are treated as debt for income tax purposes, resulting in an interest deduction to the holder of the ownership interest.

Regular instruments are treated as debt instruments for all income tax purposes. Therefore, Bank will essentially be in a similar if not identical economic position as it was prior to the sale of its debt instruments to Corporation A.

3. Result

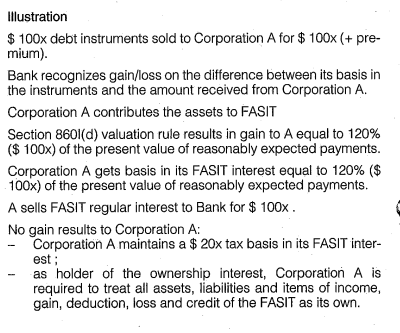

Under Scenario 2, after purchasing the debt instruments from Bank, Corporation A would contribute the instruments to a FASIT. Corporation A would then sell the regular interests to Bank while retaining the ownership interest. When Corporation A acquires debt instruments from Bank, Bank recognizes income on the difference between its tax basis in the financial assets and the purchase price. No further tax consequences result to the seller on the receipt of payment on the financial assets. Upon contribution of the debt instruments by Corporation A to the FASIT, applying the special valuation rules of Section 860I(d)(1), Corporation A will recognize capital gain equal to the sum of the present values of the reasonably expected payments under such instrument(s) using a discount rate equal to 120 percent of the applicable federal rate. The subsequent sale of regular interests to Bank, presumably for an amount equivalent to the amount paid by Corporation A to Bank for the initial acquisition of the debt instruments allows: (i) Bank to return to the same economic position it occupied prior to the initial sale of its debt instruments and (ii) Corporation A utilize the tax benefits generated by the FASIT contribution without any change in its economic structure.