A reasonable interpretation would be to adjust the net cash proceeds that Borrower received in January for the unscheduled payments that Borrower made to Lender in connection with the December transaction — a payment of $100 million in principal plus an additional payment of $10 million — because those payments in substance reduce the net proceeds Borrower received in exchange for the borrowing, but not to adjust for Borrower’s interest payment, because that payment in substance compensates Lender for Borrower’s use of the borrowed funds.

Following this interpretation, the cash proceeds to Borrower for purposes of performing an evaluation under Rev. Proc. 2008-51 equals

the $1 billion net cash proceeds to Borrower in January less the $100 million principal payment and $10 million additional payment Borrower made to Lender in December, or $890 million.

b. AHYDO Test: Amended DI would satisfy the definition of an AHYDO if it (i) is issued by a corporation, (ii) has a term greater than five years, (iii) has a yield at least 5 percent over the AFR, and (iv) has significant OID:

i. Amended DI is issued by Borrower, which is a corporation

ii. Amended DI has a duration of six years.

iii. Yield Test: At an issue price of $890 million, the yield on Amended DI would be 8.36 percent. Because the AFR that applies to Amended DI is 2.83 percent, Amended DI does have a yield that exceeds the AFR plus 5 percent (8.36 percent 2.83 percent + 5 percent, or 7.83 percent).

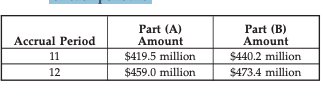

iv. Significant OID Test: Amended DI would have significant OID for purpose of this test if the sum of all interest payments made and OID accrued from its issue date through the close of any accrual period ending more than five years later (the Part (A) Amount) exceeds the amount of interest paid over the same period plus Amended DI’s issue price multiplied by its yield to maturity (the Part (B) Amount). Amended DI has two accrual periods that

end after the fifth anniversary of Amended DI’s issue date, accrual periods 11 and 12. The Part (A) Amount and Part (B) Amount for each period is:

Because the Part (A) Amount would not exceed the Part (B) Amount for either accrual period, Amended DI would not have significant OID. Because Amended DI would not have significant OID, it would not be an AHYDO, and therefore is a debt instrument described as a Secondary Instrument under Rev. Proc. 2008-51.

Amended DI was issued in an exchange after August 8, 2008; therefore it must satisfy two additional requirements to qualify for relief under Rev. Proc. 2008-51. Those requirements are that (1) the maturity date of Amended DI must not be more than one year later than the maturity date of Original DI, and (2) the SRPM of Amended DI must not exceed the SRPM of Original DI. Because the maturity date of Amended DI is identical to that of Original DI, and the SRPM of Amended DI is lower than that of Original DI, Amended DI satisfies these additional requirements as well. Therefore, Rev. Proc. 2008-51 does apply to Amended DI, and the Service will therefore not treat it as an AHYDO for purposes of section 163(e)(5) and (i).

B. Legislative Relief

1 Discussion. Congress recently enacted further relief, albeit temporary, in the American Recovery and Reinvestment Act of 2009. The act added language under both sections 163(e)(5) (the AHYDO rules) and 163(i)(1)

(the AHYDO definition). The act also provided certain temporary relief from recognition of COD income from the reacquisition (including in a debt-for-debt exchange) of business indebtedness.

First, Congress added a new subparagraph to section 163(e)(5)(F) generally suspending application of the AHYDO rules for debt instruments issued in exchange for non-AHYDO debt instruments between September 1, 2008, and the end of 2009 (although Congress also granted authority to Treasury to extend the relief to instruments issued beyond that time). This suspension is available as long as there is no change in issuer or obligor in the exchange, the instrument is not issued to a related person within the meaning of section 108(e)(4), and the interest on the obligation is not contingent interest described in section 871(h)(4)(A) through (C). If an instrument qualifying for this new relief is later exchanged for a new debt instrument, then the older instrument will not be treated as an AHYDO for purposes of determining whether the newer instrument also qualifies for the relief.

Congress also added language to section 163(i)(1) granting authority to Treasury to temporarily allow the use of an interest rate higher than the AFR for purposes of applying the AHYDO definition to an instrument. Previously, Treasury could only substitute a different rate if it were ‘‘based on the same principles’’ as the AFR and was appropriate for the term of the instrument. It is not clear what it means for a rate to be ‘‘based on the same

principles’’ as the AFR. However, because the AFR is tied to the borrowing costs of the federal government, it is doubtful that Treasury previously had authority to substitute a rate that would reflect corporate, rather than government, borrowing costs. The new authority granted Treasury, in contrast, is broadly worded, and clearly grants it the power to address the unusually wide spread that developed over the last year between corporate and government borrowing rates.

2. Applying legislative relief to example. Amended DI

is eligible for the legislative relief if:

• Amended DI was issued in exchange for a debt instrument that was not an AHYDO;

• Amended DI was issued between September 1, 2008, and the end of 2009;

• there is no change in issuer or obligor between Amended DI and Original DI;

• Amended DI was not issued to a related person; and

• interest on Amended DI is not contingent interest described in section 871(h)(4)(A) through (C).

As discussed above, Amended DI was deemed issued in exchange for Original DI by operation of reg. section 1.1001-3, and Original DI was not an AHYDO. Also, Amended DI was issued in December 2008, which falls within the scope of this relief. The issuer and obligor of Original DI and Amended DI are identical (Borrower in both cases), Amended DI was not issued to a related person (because Investors are not related to Borrower), and the interest payable under the instrument is not contingent interest described in section 871(h)(4)(A) through (C).

Therefore, under section 163(e)(5)(F)(i), the AHYDO rules do not apply to Amended DI.