The portion of OID on an AHYDO that remains deductible is only deductible when paid.65 Therefore, to calculate the OID deduction allowed to the borrower in any year, the borrower must determine (1) the amount of

deductible OID that has accrued up to that point, and (2) how much of that deductible OID it has paid. If the borrower makes payments over the life of the instrument other than payments of QSI, it becomes necessary to

allocate the deductible amount among the various payment periods of the instrument.

In general, payments under debt instruments (other than payments of QSI, which are respected as such) are attributed first to accrued and as-yet undeducted OID, and next to principal. Therefore, in general, a borrower

pays OID when and to the extent that the borrower makes any payments under the instrument that are not attributable to QSI, as long as some amount of OID has accrued and remains undeducted at the time of the

payment.

The precise interaction among the general OID accrual, payment ordering, and AHYDO rules is unclear, but some guidance is available from the legislative history. In particular, the relevant conference agreement contains examples illustrating the apportionment of paid OID into the nondeductible disqualified portion and deductible remainder. That conference agreement also states that if the YTM on an AHYDO exceeds the AFR plus 6 percentage points, then the disqualified portion is the entire amount of the OID.

In general, the portion of a payment of OID attributable to the deductible remainder equals:

Amount of OID payment x 100 percent –

(Disqualified Yield / Yield)

However, this is true only until the total amount of the remainder for the instrument has been deducted. After that, no more deduction is allowed for OID.

2. Applying AHYDO rules to example. In our example, Amended DI has total OID of $190 million (the difference between its SRPM of $950 million and its issue price of $760 million), a stated interest rate of 7 percent payable

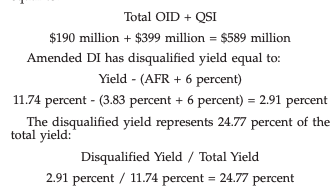

semiannually, and a yield (calculated from its issue price and payment schedule) of 11.74 percent. The AFR that applies to Amended DI is 2.83 percent. The ‘‘disqualified portion’’ (the nondeductible portion of the OID on Amended DI) is equal to the lesser of (I) the total OID, and (II) the total return multiplied by the disqualified yield. The total return on the instrument is equal to:

Therefore, the disqualified portion is the lesser of (I) $190 million, and (II) $589 million x 24.77 percent. $589 million x 24.77 percent = $145.9 million. Because this amount is less than the total amount of OID on the instrument, the disqualified portion for Amended DI is $145.9 million. The remainder (the portion of OID on Amended DI that is deductible when paid) is equal to:

Total OID – Disqualified Portion

$190 million – $145.9 million = $44.1 million

Because Amended DI does not call for any payments before maturity other than payments of QSI, all of the deductible remainder is paid at maturity. Therefore, it is not necessary to allocate the remainder among the various payment periods. The application of the AHYDO rules to Amended DI yields surprising results. One of the surprises is that the portion of OID that is made permanently nondeductible by the AHYDO rules is 77 percent of the total $190 million, even though the disqualified yield represents less than a quarter of the total yield. This is because the AHYDO rules work by disallowing a portion of the total return on the obligation (rather than a portion of the OID) subject to a cap equal to the amount of OID.

A second surprise is how the AHYDO rules alter the expected relationship between the COD income Borrower recognized on the exchange and Borrower’s OID deductions. Borrower recognized $153.5 million in COD income on its deemed exchange of Original DI for Amended DI and $10 million cash, and total OID on Amended DI increased over the amount of OID on Original DI by the same amount ($153.5 million). If all the OID on Amended DI were ultimately deductible, Borrower would eventually recapture the full $153.5 million of COD income it realized on the exchange through a total increase in OID deductions over the remaining term of the borrowing of $153.5 million. However, because of the AHYDO rules, Borrower is prevented from deducting $145.9 million of the OID on Amended DI. Therefore, in this example, Borrower is prevented from recapturing 95 percent of the COD income it must recognize on the exchange.