C. Scenario 3: Corporation A Acquires debt instruments from Bank, Corporation A retains all FASIT interests.

- Purchase of debt instruments

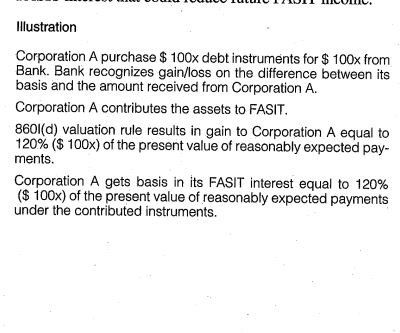

Corporation A purchases “permitted debt instruments” from Bank in order to participate in the instant transaction. Bank recognizes income on the difference between its tax basis in the financial assets and the purchase price. No further tax consequences result to the seller (Bank) on the receipt of payment on the financial assets. Corporation A owns debt instruments with cost basis and contributes the debt instruments to a newly created FASIT.

2. Contribution of debt instruments

Upon contribution, Corporation A will be subject to the special valuation rule for instruments that are no traded on an established securities market. Therefore, the value of the property transferred to the FASIT will equal the sum of the present values of the reasonably expected payments under such instrument (determined in a manner to be provided by Treasury Regulations) using a discount rate equal to 120 per cent of the applicable Federal rate. As the holder of the ownership interest, Corporation A is required to treat all assets, liabilities, and items of income, gain, deduction, loss, and credit of the FASIT as its own. (Consequences of contribution are discussed more full in Scenario 1)

a. Tax consequences

Upon contribution Corporation A will recognize gain equal to the sum of the present values of the reasonably expected payments under the instrument(s) using a discount rate of 120 per cent of the AFR. Corporation A’s FASIT contributions result in an increase in basis that reflects the additional gain incurred by Corporation A due to the application of the special valuation rule. As a result, Corporation A has capital gain that may be offset against its expiring capital losses and creates a high basis in its FASIT interest that could reduce future FASIT income.

D. Scenario 4: Corporation A owns the necessary debt instruments, retains the ownership interest, and sells FASIT regular interests to Bank or public

- Contribution to FASIT

Corporation A possesses the necessary debt instruments and may contribute such such assets directly to the FASIT. As the owner of the FASIT, Corporation A will be subject to the special valuation rule upon contribution of asset that are not traded on an established securities market. Therefore, the value of the property transferred to the FASIT will equal the sum of the present values of the reasonably expected payments under such instruments (determined in a manner to be provided by Treasury Regulations) using a discount rate equal to 120 percent of the applicable Federal rate. (Consequences of contribution are discussed more full in Scenario 1.)

2. Sales of regular interest(s)

As the holder of the ownership interest, Corporation A may sell regular FASIT interests to a bank, the public or some combination of the two. The sale price of the regular interest would approximate the value of the underlying debt instruments, which should be calculated absent the special valuation rule of S860I(d)(1). Upon sale, Corporation A will recognize gain/loss on the difference between its tax basis in the financial assets and the sale price.